Pay for an even more high priced possessions by protecting to the financial interest costs

Article realization

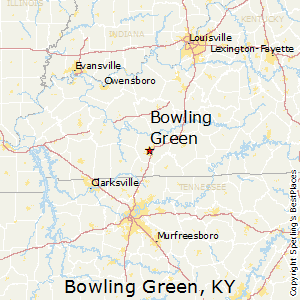

- Minimal called for salary varies from area in order to city, once the area has an effect on an average property rates.

- The minimum requisite salaries the following account fully for VAT, and you will monthly expenditures such as for instance gasoline and you will eating.

- You can utilize all of our Bond Calculator to choose the financial you might be eligible for according to your month-to-month money.

How far out is the imagine possession? Most people are asking that it concern, and something of one’s primary affairs they want to need on the membership is their salary. How much cash must i earn ahead of I can believe applying for home financing?

- R22 600 on Western Cape, in which the mediocre assets price is R680 000 (the costliest of all of the provinces).

- R12 600 on Eastern Cape, where in fact the average possessions pricing is R380 000 (the lowest of all provinces).

- R20 600 when you look at the Gauteng, in which the average assets price is R620 000.

The study assumes good 20 seasons home loan title, into visitors using 31% of its terrible monthly earnings to cover it, and thus taking into consideration other costs one the earnings would have to cover, instance gasoline and food.

Additionally, it assumes on a solo visitors; a few to get a home manage naturally manage to blend its revenues in order to pick a expensive property.

Our Thread Calculator is actually a very important equipment enabling you to definitely estimate the home loan you’ll qualify for, plus month-to-month costs; centered on your net income and monthly costs.

Such as, a deluxe coastline assets inside the Llandudno do rates R11 700 000 typically, demanding a monthly salary from R389 eight hundred.

- Fresnaye, Cape City: Average possessions price is R6 400 000, requiring a month-to-month money from R213 000.

- Tableview, Cape Urban area: Mediocre possessions pricing is R1 250 000, requiring a monthly earnings regarding R41 600.

- Dunkeld, Johannesburg: Average possessions pricing is R9 850 000, requiring a monthly money off R327 800.

How about brand new put?

The necessary put is often 10% of the home rate. Without a doubt, the better your put, the greater number of you try the website can afford to invest into home financing. This basically means, a high put will enable you to acquire a far more expensive assets.

Of several earliest-go out customers pick the 100% mortgage, hence eliminates the necessity for in initial deposit. This will cause high monthly payments, but it produces homeownership the possibility in the event you can’t scrape together the amount of money to cover a deposit.

But if you have time and you will determination, you will want to save currency to pay for in initial deposit with the a house get, because will benefit you in the long term. Our Deposit Coupons Calculator will help you to determine how much your must save yourself during a period of time for you pay money for a deposit to your a property.

Bringing a mortgage which have low interest rates will make it simple for one to afford a home that first have appeared above the paygrade.

Within ooba Mortgage brokers, South Africa’s largest home loan investigations services, we can help you do so from the distribution your house financing software to numerous banking companies, allowing you to compare bundles and get the best offer. We have insurance packages like auto and you will home insurance (among the many more costs you will need to be the cause of when purchasing a property).

Likewise, we provide a range of gadgets that make the home to order process simpler. Start by the Thread Calculator, after that fool around with the Thread Signal to determine what you really can afford. Eventually, before you go, you could potentially sign up for home financing.